- News

- City News

- chennai News

- Kalki Bhagavan case: 900 acres of benami land attached by I-T

Trending

This story is from December 21, 2019

Kalki Bhagavan case: 900 acres of benami land attached by I-T

The income tax department has issued a lookout notice under Section 230 (1A) of the Income Tax Act to Preetha Krishna, daughter-in-law of self-styled godman Kalki Bhagavan, after it found crores of unaccounted money in the form of cash, foreign currencies and undeclared assets during searches on different premises linked to her.

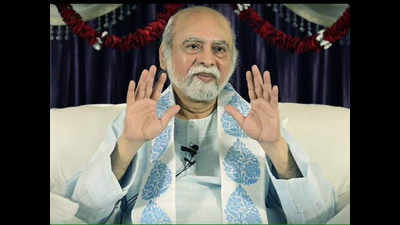

Self-styled godman Kalki Bhagavan (Image courtesy: @OnenessUniversity/FB)

CHENNAI: The income tax department has issued a lookout notice under Section 230 (1A) of the Income Tax Act to Preetha Krishna, daughter-in-law of self-styled godman Kalki Bhagavan, after it found crores of unaccounted money in the form of cash, foreign currencies and undeclared assets during searches on different premises linked to her.

The department has initiated action against Preetha Krishna and her husband N K V Krishna and has provisionally attached more than 900 acres of land in Tamil Nadu, Andhra Pradesh and Karnataka under Benami Transactions (Prohibition) Act, 1988.The I-T searches began on October 16 and as per a CBDT press release, Rs 43.9 crore in Indian currencies and US $2.5 million were seized. A copy of the lookout notice, issued last month and available with TOI, shows that during searches at the residence of Preetha Krishna at Shyamala Gardens on ECR, Akkarai, unaccounted cash worth Rs 23.87 crore and foreign currency of $1.25 million were seized.

Preetha Krishna had sought a tax clearance certificate from the I-T department for travelling abroad. The notice issued by I-T investigation wing assistant director K Mahadevan said, “Your presence is necessary in investigation under I-T and Wealth Tax Acts. Hence, a lookout notice is being issued and permission for travelling to the US and Ukraine cannot be granted”.

The department had seized gold jewels worth Rs 1.68 crore and diamonds worth Rs 1.7 crore from her residence. “The department has found lands were purchased by Preetha Krishna and her husband NKV Krishna in the names of employees,” said the notice.

The notice said the Enforcement Directorate had been intimated about the foreign currencies seized from the premises.

The family had diverted huge amount of money to bank accounts in the US and other foreign countries, shows the I-T investigation.

The department has initiated action against Preetha Krishna and her husband N K V Krishna and has provisionally attached more than 900 acres of land in Tamil Nadu, Andhra Pradesh and Karnataka under Benami Transactions (Prohibition) Act, 1988.The I-T searches began on October 16 and as per a CBDT press release, Rs 43.9 crore in Indian currencies and US $2.5 million were seized. A copy of the lookout notice, issued last month and available with TOI, shows that during searches at the residence of Preetha Krishna at Shyamala Gardens on ECR, Akkarai, unaccounted cash worth Rs 23.87 crore and foreign currency of $1.25 million were seized.

Preetha Krishna had sought a tax clearance certificate from the I-T department for travelling abroad. The notice issued by I-T investigation wing assistant director K Mahadevan said, “Your presence is necessary in investigation under I-T and Wealth Tax Acts. Hence, a lookout notice is being issued and permission for travelling to the US and Ukraine cannot be granted”.

The department had seized gold jewels worth Rs 1.68 crore and diamonds worth Rs 1.7 crore from her residence. “The department has found lands were purchased by Preetha Krishna and her husband NKV Krishna in the names of employees,” said the notice.

The notice said the couple had invested in a number of companies in UAE, Europe and the US through Lotus Capital Investment Holding, a Singapore entity. “You are a substantial shareholder in the Indian subsidiary, Global Arkitekts Pvt Ltd but no beneficial interest has been disclosed by you and Krishna in his return of income filed. Hence a notice has been issued under section 10 (1) Black Money (undisclosed foreign income and assets) and Imposition of Tax Act. But no response has been received till date,” said the notice.

The notice said the Enforcement Directorate had been intimated about the foreign currencies seized from the premises.

The family had diverted huge amount of money to bank accounts in the US and other foreign countries, shows the I-T investigation.

End of Article

FOLLOW US ON SOCIAL MEDIA