- News

- India News

- Fossil fuel usage set to drop for 1st time

Trending

This story is from September 15, 2020

Fossil fuel usage set to drop for 1st time

NEW DELHI: India’s thirst for fossil fuels will outpace China’s by a big margin, even though globally, consumption will shrink for the first time in modern history through 2050 as climate initiatives propel renewable energy while the coronavirus pandemic leaves a lasting scar on demand, the benchmark BP Energy Outlook 2020 said on Monday.

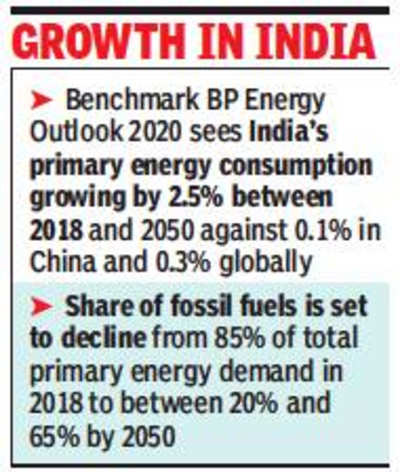

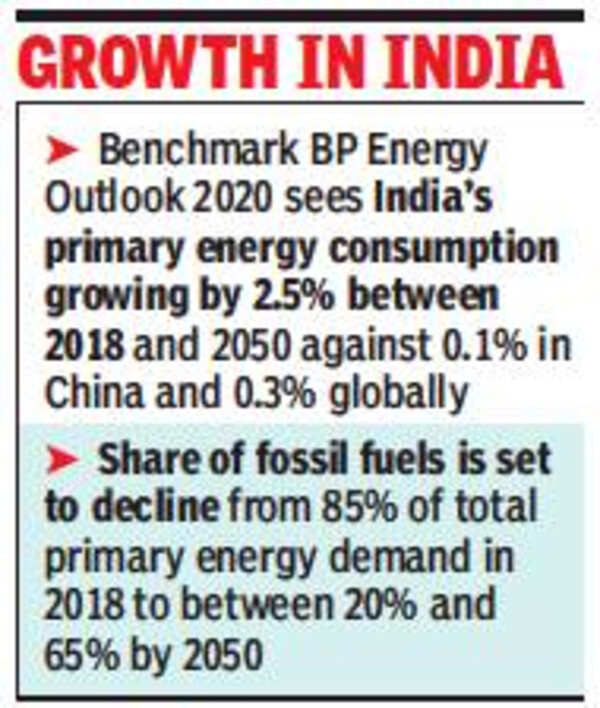

The outlook saw India’s primary energy consumption growing by 2.5% between 2018 and 2050 against 0.1% in China and 0.3% globally.It sees India’s oil consumption more than doubling to 10 million barrels by 2050 under the ‘business-as-usual’ scenario. But gas demand is seen jumping from 58 bcm (billion cubic meters) to 357 bcm under the ‘rapid’ scenario. “India’s combined oil and gas imports more than double by 2050, driven in part by increased coal-to-gas switching which leads to a marked deepening in India’s dependence on imported LNG,” the outlook said.

Globally, fossil fuel demand may not rise to pre-Covid levels

Though the report sees growth in China’s energy demand slowing sharply relative to past trends — peaking in the early 2030s — it will still remain the largest market for energy in all scenarios, including ‘net zero’, to account for over 20% of the world’s energy demand in 2050. This will be almost twice that of India.

But globally, fossil fuel demand may never recover to pre-coronavirus levels as the pandemic hastens “fundamental restructuring” of the energy business. The share of fossil fuels is set to decline from 85% of total primary energy demand in 2018 to between 20% and 65% by 2050 in the three scenarios, it said.

India’s fuel sales more than halved in April as the countrywide lockdown confined people to their homes and shut almost all economic activities. Demand shot up to nearly 80% of the pre-lockdown level after the government began lifting curbs in June but faltered in August, down 15.6% from the year-ago period. “Demand for oil falls over the next 30 years. The scale and pace of this decline is driven by the increasing efficiency and electrification of road transportation,” the report said, adding the outlook for natural gas was more resilient than for oil, underpinned by its role in supporting fast-growing developing economies as they de-carbonised and reduced their reliance on coal.

The outlook saw India’s primary energy consumption growing by 2.5% between 2018 and 2050 against 0.1% in China and 0.3% globally.It sees India’s oil consumption more than doubling to 10 million barrels by 2050 under the ‘business-as-usual’ scenario. But gas demand is seen jumping from 58 bcm (billion cubic meters) to 357 bcm under the ‘rapid’ scenario. “India’s combined oil and gas imports more than double by 2050, driven in part by increased coal-to-gas switching which leads to a marked deepening in India’s dependence on imported LNG,” the outlook said.

Globally, fossil fuel demand may not rise to pre-Covid levels

Though the report sees growth in China’s energy demand slowing sharply relative to past trends — peaking in the early 2030s — it will still remain the largest market for energy in all scenarios, including ‘net zero’, to account for over 20% of the world’s energy demand in 2050. This will be almost twice that of India.

But globally, fossil fuel demand may never recover to pre-coronavirus levels as the pandemic hastens “fundamental restructuring” of the energy business. The share of fossil fuels is set to decline from 85% of total primary energy demand in 2018 to between 20% and 65% by 2050 in the three scenarios, it said.

India’s fuel sales more than halved in April as the countrywide lockdown confined people to their homes and shut almost all economic activities. Demand shot up to nearly 80% of the pre-lockdown level after the government began lifting curbs in June but faltered in August, down 15.6% from the year-ago period. “Demand for oil falls over the next 30 years. The scale and pace of this decline is driven by the increasing efficiency and electrification of road transportation,” the report said, adding the outlook for natural gas was more resilient than for oil, underpinned by its role in supporting fast-growing developing economies as they de-carbonised and reduced their reliance on coal.

End of Article

FOLLOW US ON SOCIAL MEDIA