The Nifty50 which started the week on a positive note looked set to reclaim 10,900 levels, but bears slowly took control and pushed the index towards 10,700 on Friday.

The Nifty50 finally closed 1.52 percent higher compared to 1.59 percent rally seen in the S&P BSE Sensex.

The mixed performance was seen from the broader market space as the S&P BSE Midcap index rose just 0.81 percent while the S&P BSE Smallcap index closed with gains of 1.59 percent for the week ended July 10.

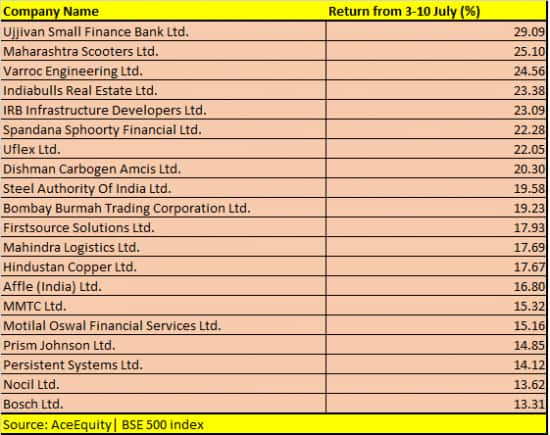

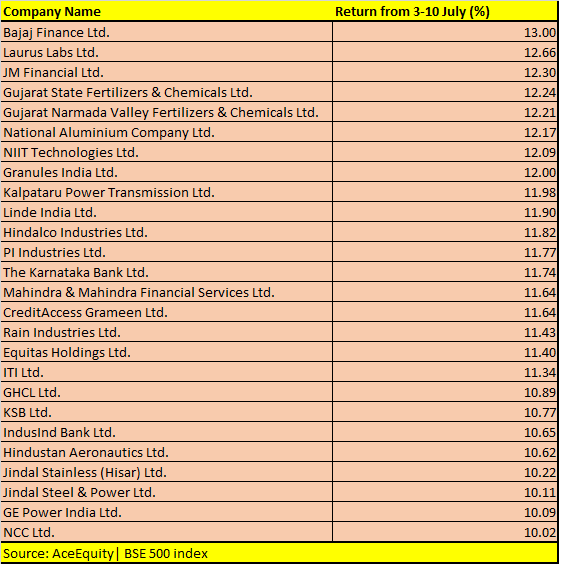

However, as many as 46 stocks in the S&P BSE500 index that rose 10-30 percent for the week ended July 10. These include NCC, GE Power, Jindal Steel & Power, IndusInd Bank, Equitas Holdings, Karnataka Bank, IRB Infrastructure, and Ujjivan Small Finance Bank, among others.

“Markets started the week on a promising note however mixed cues capped movement as the sessions progressed. In between, volatility remained high as domestic markets continued to dance on the tune of global peers and increasing COVID cases worldwide kept markets on edge,” Ajit Mishra, VP - Research, Religare Broking Ltd told Moneycontrol.

“Nonetheless, investors’ sentiments were boosted on news of easing of geopolitical tension between India and China as well as encouraging PM’s speech at the India global week summit,” he said.

Nifty outlook for the week:

Equity benchmarks extended gains over the fourth consecutive week amid lackluster global cues. The Nifty ended the week at 10768, up 161 points, or 1.5 percent.

Broader markets continued to outperform as Nifty midcap and small-cap rose 1.4 percent and 3.5 percent, respectively. Sectorally, metal, financials and IT outshone during the week while infra and energy took a breather.

The Nifty50 managed to reclaim 10600 on the closing basis for the week ended July 10, and the next big resistance is placed around 10900, but before that experts see some consolidation.

“In the coming week we expect the index to undergo healthy consolidation in the broad range of 10,900-10,600 amid stock-specific action as we enter the Q1FY21 result season,” Dharmesh Shah, Head – Technical, ICICI direct told Moneycontrol.

“Over the past quarter, we have observed a significant jump in daily cash turnover. As compared to April average (Rs 49,000 crore), current turnover stands near Rs 60,000 crore. An increasing trend suggests a growing appetite for equities which augurs well from a medium-term perspective,” he said.

Shah further added that with improving the market breadth, buying demand at the elevated support base, makes us confident of revising the support base at 10600 for the Nifty50.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!