For, it threatens to not only derail India’s bull market, but also disturb the government’s fiscal arithmetic, should it lead to a spike in crude oil prices as is being speculated.

Reacting on the news, oil prices surged over 4 per cent in international markets. The black gold rallied more than 35 per cent in the domestic market in 2019. India imports 83 per cent of its oil needs.

Domestic equity benchmarks Sensex and Nifty declined a quarter per cent in early trade on Friday, as global equities turned negative in anticipation of a conflict in the major oil producing belt.

“The news of US strike killing Qassem Soleimani is very significant, as he was extremely close to the Iranian Supreme Leader. Iran will certainly retaliate. Oil is likely to be on the boil. It’s bad news for large oil importing countries, especially those like India, which run large trade and current account deficits,” said Ajay Bodke, CEO-PMS, Prabhudas Lilladher.

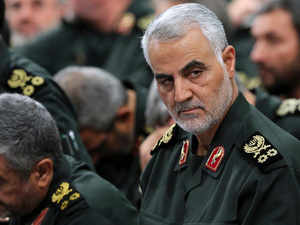

Soleimani, the head of Iran's Quds Force, was hit in an attack on the Baghdad International Airport early Friday, reports said. Iranian Supreme Leader Ayatollah Khamenei said ‘severe retaliation’ awaits Soleimani killers.

India's fiscal deficit reached an alarming level at the end of November at 114.8% of the budgeted target for the financial year, highlighting the challenge the government faces in meeting its fiscal goals. The deficit, or the gap between the government’s total receipts and expenditure, reached Rs 8.07 lakh crore as of November 30, official data showed last week.

Meanwhile, current account deficit (CAD) – the gap between value of total imports and aggregate exports – narrowed to 0.9 per cent of GDP, or $6.3 billion, in the September 2019 quarter, on account of a lower trade deficit. It stood at 2.9 per cent of GDP, or $19 billion, in the corresponding quarter of 2018-19. It was 2 per cent of GDP, or $14.2 billion, in June quarter, 2019.

“Indian equities better take note. Risk aversion would spike sharply. Investors may again find comfort in mega-caps and shun 'risky' smallcap and midcap equities,” Bodke said,

He said Iran could strike either directly or through its numerous proxies in the region in countries like Iraq, Yemen, Syria, Lebanon with the intention of causing massive damage to the US and its Gulf allies, like Saudi Arabia, UAE and Kuwait.

It is likely to aim at causing massive disruption of supply routes through the Persian Gulf or strike at key oil installations besides striking US military or civil interests in the Gulf and beyond, he said.

As risky assets plummeted globally, investors preferred to go with safe haven gold and silver. MCX Gold traded 1.12 per cent higher at Rs 39,715 per 10 gm at around 10.10 am (IST), while MCX Silver rose 0.87 per cent to Rs 47,429 per 1 kg.

Analysts said market participants should watch domestic bond yields as any outflow by foreign institutional investors due to rising risk aversion may spark a selloff, leading to rise in bond yields. Foreign portfolio investors poured more than Rs 1 lakh crore into Indian equities and Rs 25,805 crore in domestic debt last year.

“Trump strike on General Qassem Soleimani of Iran is a big escalation in the Middle East conflict from last decade. The General is among the top three leader from a military perspective. His influence stretched from Yemen, Syria to Iraq. Expect crude to boil if Iran retaliates,” said Abhimanyu Sofat, Head of Research, IIFL Securities.

In her interaction with ETNOW, Vandana Hari, Founder & CEO, Vanda Insights, said the latest US-Iran conflict could escalate into a bigger war. “It is a big deal, and I am not surprised we are seeing more than 3.5 per cent jump in crude. Until the situation becomes clearer, it is going to be a kneejerk reaction factoring in the risk premium. We have to see Iran’s action in response to the killing of General Soleimani.”

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times