His exit — along with that of Rajan, Patel and CEA Arvind Subramanian — was a "form of dissent", Acharya revealed during an Idea Exchange online interaction with Indian Express.

Rajan, however, had left the RBI after the completion of his first (and only) term, unlike Acharya and Patel who chose to quit midway.

Acharya is of the belief that in the last decade central bankers who resorted to tact while dealing with the government, did not produce any better outcomes.

Acharya quit in 2019, six months before the end of his term amid what he says was his growing frustration regarding RBI’s autonomy, joining the queue of notable exits from the central bank that was started by Rajan — with Patel following in his predecessor's footsteps in late 2018.

Simmering tensions between the Reserve Bank and the government started with a shift to a market-based economy from a nationalized system, Acharya said. The roots of the tussle over RBI's autonomy can be traced back to this shift, he added.

The former deputy governor, however, urged caution against taking these much-hyped exits at face value. "We should not interpret exits as a problem. In my view, we should interpret exits as a form of voice, as a form of dissent that the system requires to have the right public debates and get to the right path," he told Express.

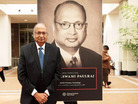

For Acharya, this is not a new line of discourse. During his speech at the AD Shroff Memorial Lecture in 2018, he had likened this govt’s decision-making to a T20 match: "Myopia or short-termism of governments is best summarised in history by Louis XV when he proclaimed “Apres moi, le deluge!” (After me, the flood!)."

On that occasion, Acharya had gone on to say that unlike governments, central banks play a Test match, "trying to win each session, but importantly also survive it, so as to have a chance to win the next session."

The recurring issue between the RBI and the govt revolves around disagreements about rate setting. According to Acharya, the government wants RBI to be accommodative and uses political pressure to enact this ‘fiscal dominance’. In the government's focus on short-term boosters through liquidity and credit, it ignores long-term plans for stability, he said.

The other side of the argument finds its roots in the RBI Act of 1934, which has its origins in British administration and the word ‘autonomy’ doesn’t make an appearance. The freedoms that RBI postulates exist rather in the US Federal Reserve, and the push towards them is legislative.

"A number gets announced as the real deficit and everyone is happy...everyone in the system says oh how can we question the real official statistics of the government. But when they are not right, they are not right. I want to fundamentally disagree with the thesis that those who agree have been able to pave a better outcome for the country,” Acharya said.

Acharya says a growth mindset has dominated the central bank’s monetary policy decision in recent times, blurring the lines between the govt and RBI’s primary mandate.

The MPC answers a catch-22 on Thursday in choosing between rate cuts to further aid growth or managing the higher-than-expected inflation rate amid the Covid-19 pandemic. Acharya suggests the rate-setting panel 'respect' its core mandate of controlling price rise during the upcoming policy review meet.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the ET ePaper online.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the ET ePaper online.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times