- News

- Business News

- India Business News

- RBI revamps norms for priority sector loans, adds startups

Trending

This story is from September 5, 2020

RBI revamps norms for priority sector loans, adds startups

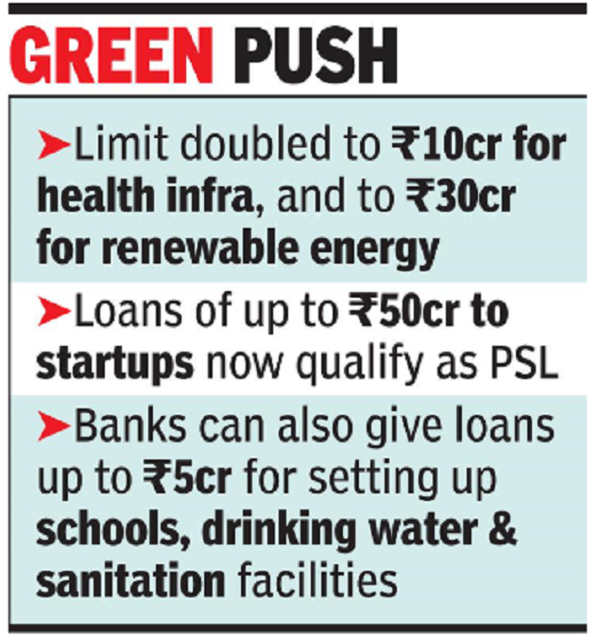

The Reserve Bank of India (RBI) has overhauled its priority sector lending (PSL) norms to boost fund flows to districts that have been excluded and has doubled its limit for health infrastructure to Rs 10 crore, and for renewable energy to Rs 30 crore. According to the new norms, loans of up to Rs 50 crore to startups (as defined by the industry ministry) also qualify as PSL.

Representative image

MUMBAI: The Reserve Bank of India (RBI) has overhauled its priority sector lending (PSL) norms to boost fund flows to districts that have been excluded and has doubled its limit for health infrastructure to Rs 10 crore, and for renewable energy to Rs 30 crore. According to the new norms, loans of up to Rs 50 crore to startups (as defined by the industry ministry) also qualify as PSL.

With agriculture being the only sector that is expected to grow during the current fiscal year, the RBI has decided to ramp up credit flow to this segment and said targets prescribed for small and marginal farmers and weaker sections will be increased in a phased manner. Banks can now lend up to Rs 5 crore to Farmer Producer Organisations (FPOs) and individual households can get loans up to Rs 10 lakh for renewable energy generation.

Banks can also give loans up to Rs 5 crore for setting up schools, drinking water facilities and sanitation facilities. Post Covid-19, healthcare, sanitation and startups have emerged as focus areas and the government is keen to support these sectors. Clean energy is another key area that has received attention in recent years.

The new norms will benefit microlenders who cater to the priority sector as defined by the RBI. This is because banks have been allowed to buy such loans or invest in securitised assets, representing loans to various categories of priority sector, except ‘others’ category, and these will qualify for priority sector.

“The revision in guidelines will incentivise credit flow to specific segments like clean energy, weaker sections, health infrastructure and credit-deficient geographies. These measures are also aligned to focus areas of development according to extant policy environment and will support funding requirements in these specific sectors,” Crisil Ratings senior director Krishnan Sitaraman said.

The fresh categories eligible for finance under priority sector include loans to farmers for installation of solar power plants for solarisation of grid-connected agriculture pumps and loans for setting up Compressed Bio Gas (CBG) plants. According to the RBI, the revised guidelines will correct the regional disparities in the flow of priority sector credit. This has been done by giving higher weightage to fresh loans in “identified districts where priority sector credit flow is comparatively low”.

The priority sector norms were last revised in 2015 and new segments — including medium enterprises, social infrastructure and renewable energy — were included. In recent years, home loans have dominated priority sector lending as these were seen as the safest in this category by banks. Around 40% of bank loans are to mandatorily be made in the priority sector. Lenders who fail to do so are penalised by being forced to invest in low-yielding government investments.

With agriculture being the only sector that is expected to grow during the current fiscal year, the RBI has decided to ramp up credit flow to this segment and said targets prescribed for small and marginal farmers and weaker sections will be increased in a phased manner. Banks can now lend up to Rs 5 crore to Farmer Producer Organisations (FPOs) and individual households can get loans up to Rs 10 lakh for renewable energy generation.

Banks can also give loans up to Rs 5 crore for setting up schools, drinking water facilities and sanitation facilities. Post Covid-19, healthcare, sanitation and startups have emerged as focus areas and the government is keen to support these sectors. Clean energy is another key area that has received attention in recent years.

“The inclusion of startups in PSL will reduce their cost of capital by allowing them better access to bank credit. Going forward, equity infusion will not be the only route to follow when startups need funds for working capital requirements, and this will greatly ease the risk of ordinary shareholders being wiped out due to ‘down-rounds’,” said SBI chief economist Soumya Kanti Ghosh. However, to boost lending to startups, it is also imperative to set in place an institutional mechanism as they don’t have collateral and performance evaluation mechanism matrix, he added. The RBI last revised PSL norms in 2015.

The new norms will benefit microlenders who cater to the priority sector as defined by the RBI. This is because banks have been allowed to buy such loans or invest in securitised assets, representing loans to various categories of priority sector, except ‘others’ category, and these will qualify for priority sector.

“The revision in guidelines will incentivise credit flow to specific segments like clean energy, weaker sections, health infrastructure and credit-deficient geographies. These measures are also aligned to focus areas of development according to extant policy environment and will support funding requirements in these specific sectors,” Crisil Ratings senior director Krishnan Sitaraman said.

The fresh categories eligible for finance under priority sector include loans to farmers for installation of solar power plants for solarisation of grid-connected agriculture pumps and loans for setting up Compressed Bio Gas (CBG) plants. According to the RBI, the revised guidelines will correct the regional disparities in the flow of priority sector credit. This has been done by giving higher weightage to fresh loans in “identified districts where priority sector credit flow is comparatively low”.

The priority sector norms were last revised in 2015 and new segments — including medium enterprises, social infrastructure and renewable energy — were included. In recent years, home loans have dominated priority sector lending as these were seen as the safest in this category by banks. Around 40% of bank loans are to mandatorily be made in the priority sector. Lenders who fail to do so are penalised by being forced to invest in low-yielding government investments.

End of Article

FOLLOW US ON SOCIAL MEDIA