- News

- City News

- bengaluru News

- CBI gets Karnataka nod to prosecute two top IPS officers in IMA scam

Trending

This story is from September 15, 2020

CBI gets Karnataka nod to prosecute two top IPS officers in IMA scam

The Karnataka government has given sanction to prosecute five police officers, including IPS officers Hemanth Nimbalkar and Ajay Hilori, for their alleged role in the Rs 4,000-crore IMA (I Monetary Advisory) Ponzi scheme.

On September 9, the government granted permission to the CBI, which has investigated the scam in which the IMA duped lakhs of investors of more than Rs 4,000 crore promising higher returns.

BENGALURU: The Karnataka government has given sanction to prosecute five police officers, including IPS officers Hemanth Nimbalkar and Ajay Hilori, for their alleged role in the Rs 4,000-crore IMA (I Monetary Advisory) Ponzi scheme.

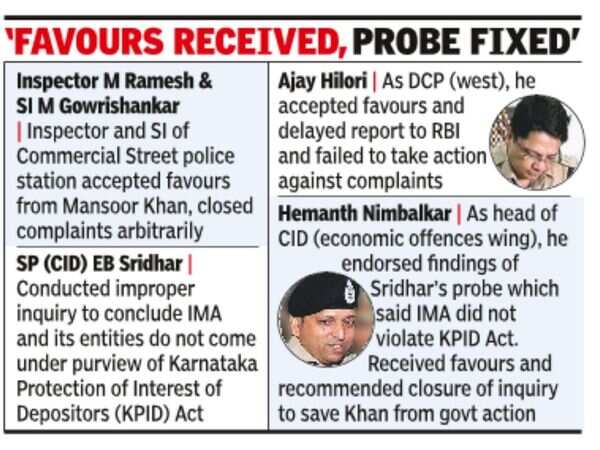

The other officers are then DSP EB Sridhar, inspector M Ramesh and sub-inspector Gowrishankar. Nimbalkar was IGP of CID and Hilori was DCP (West) at that time.

On September 9, the government granted permission to the CBI, which has investigated the scam in which the IMA duped lakhs of investors of more than Rs 4,000 crore promising higher returns.The central agency had sought permission from the state government for prosecution in December 2019.

The government order said the CBI has held that Nimbalkar, Hilori and Sridhar favoured IMA ascertaining in their inquiry report that these companies are not financial establishments under the definition of KPID Act and the deposits received by them are exempted under the act. The CBI said these officers received favours from IMA in in return for their help.

Prior to the CBI, the CID's economic offence wing had inquired into the IMA affairs, following a directive from the then DG&IGP after the RBI referred the matter to him stating IMA and related entities were taking deposits from the public by promising a high rate of returns without obtaining any authorization or NBFC licence under the guise of Islamic Banking Practice.

The other officers are then DSP EB Sridhar, inspector M Ramesh and sub-inspector Gowrishankar. Nimbalkar was IGP of CID and Hilori was DCP (West) at that time.

On September 9, the government granted permission to the CBI, which has investigated the scam in which the IMA duped lakhs of investors of more than Rs 4,000 crore promising higher returns.The central agency had sought permission from the state government for prosecution in December 2019.

The five officers have been charged with conspiring with IMA founder Mohammed Mansoor Khan and others for protecting the interest of IMA and its entities. They will be tried under CrPC, Karnataka Police Act and Karnataka Protection of Interest on Depositors Financial EstablishmentAct.

The government order said the CBI has held that Nimbalkar, Hilori and Sridhar favoured IMA ascertaining in their inquiry report that these companies are not financial establishments under the definition of KPID Act and the deposits received by them are exempted under the act. The CBI said these officers received favours from IMA in in return for their help.

Prior to the CBI, the CID's economic offence wing had inquired into the IMA affairs, following a directive from the then DG&IGP after the RBI referred the matter to him stating IMA and related entities were taking deposits from the public by promising a high rate of returns without obtaining any authorization or NBFC licence under the guise of Islamic Banking Practice.

End of Article

FOLLOW US ON SOCIAL MEDIA