Following the flash crash, the Indian equities market made a nifty comeback rising 50 percent since March lows. However, the relief rally which turned into that of hope and optimism has pushed valuations to the expensive territory, hence, the market has been consolidating in a narrow range for the last couple of weeks.

As most positives seem to be discounted, the market will look for fresh cues to decide its path going forward, but experts don't see a major correction anytime soon. Falling volatility has also provided support to the D-Street.

Ample liquidity from central banks across the world and record retail participation has kept the party going on the Street. Also, the solid response to fundraising plans of various companies hints that the rally may continue in the near-term, experts feel.

The better-than-expected earnings in June quarter on the back of muted expectations, improvement in economic activities after the lifting of lockdown and several measures taken by government also lifted sentiment.

The upside seen was not restricted to benchmark indices as the broader markets also saw a run-up in the same timeframe especially after consistent underperformance witnessed since 2018.

Major sector-wise participation was seen in IT (up 62 percent), pharma (up 80 percent), metals (up 57 percent) and auto (up 68 percent) from March lows.

"We observe that 'value' has been the most dominant theme over the last three months which has beaten growth, quality and momentum. While value has outperformed we believe that the outperformance will not last as growth and quality are more likely to pick up as we have seen historically," Axis Securities said in its report which was prepared by Naveen Kulkarni.

The brokerage also sees midcaps and smallcap performance slowly picking up.

"We believe that once the volatility index settles below 20 then midcaps and smallcaps are likely to see significant outperformance. We continue to believe that allocation to mid and smallcaps will result in decent returns over the next 12 months," said Axis Securities.

India VIX, which measures the volatility, has consistently fallen for the last several weeks. It was around 20-21 levels at the time of writing this copy.

"Currently VIX is in the comfort zone, which indicates the market is less risky versus the levels it was trading three months back. During March 2020, VIX was trading in panic zone of 80 levels, which was earlier seen during the 2009 crisis," Axis said.

Given the rally across sectors, experts feel the valuations are not at comfort levels except in banking & financials which has been hurting by the asset quality issues.

"Except for the BFSI sector, there is limited valuation comfort across sectors but the BFSI sector has balance sheet challenges. Nifty is currently trading at 18.7x FY22E earnings. While we are seeing broad-based improvement across the sectors the current valuations factor the improvement," said the brokerage.

"Valuing Nifty at 19x FY22E earnings we arrive at our December Nifty target of 11210 which provides limited upside potential, hence it will be critical to invest in quality midcaps and small caps to generate outperformance and absolute returns," it added.

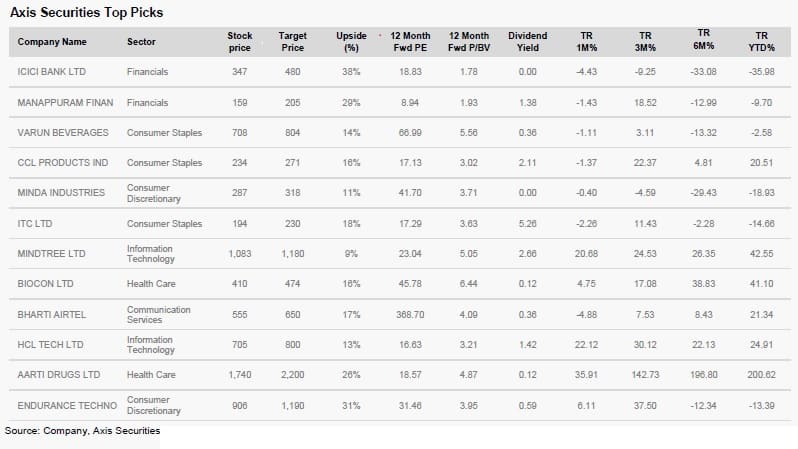

The brokerage has recommended 12 stocks in August which include ICICI Bank, ITC, Manappuram Finance, Bharti Airtel, HCL Tech, Mindtree, Varun Beverages, CCL Products, Aarti Drugs, Biocon, Minda Industries and Endurance Technologies.

Axis Securities believes themes of digital, pharmaceuticals, rural plays, supply chains shifts, consumer staples and small ticket discretionary are long-term and maintained focus on stock selection.

The brokerage added Aarti Drugs and Endurance Technologies to its top picks list.

"Aarti Drugs is a play on high growth API business and it is undervalued at current levels compared to its peers and thus offers decent upside from current levels. Endurance, on the other hand, is a play on the resilient two-wheeler industry which is likely to outperform the auto industry," it reasoned.

Axis has an overweight call on consumer staples, IT, pharma, specialty chemicals and telecom, but is underweight on oil & gas, BFSI, capital goods and real estate.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!