Indian market rose more than 14 percent in April recording the best monthly return for April over the last 10 years. The bullish momentum which was seen across the globe helped more than 30 Portfolio Management Schemes (PMSes) to outperform the index in the same period.

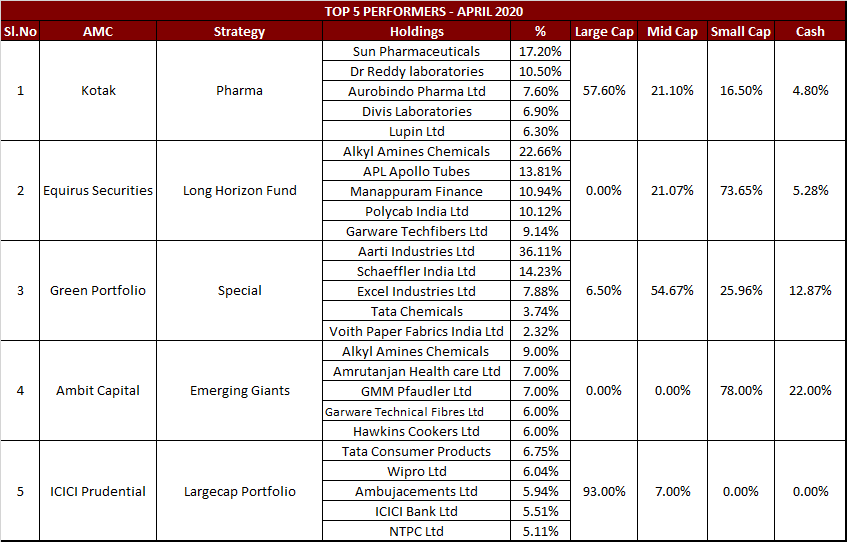

As many as 33 PMS schemes managed to outperform the index with Kotak AMC’s Pharma fund topping the list, returning 26 percent during the month gone by, data collated by PMSBazaar.com, an online portal used for PMS comparison, showed.

Other PMS schemes that outperformed the index include Equirus Securities Long Horizon Fund, which is a mid & smallcap fund, registered a return of 24 percent in April, followed by Green Portfolio’s Special Multicap Fund which rose 20 percent in the same period.

ICICI Prudential Largecap portfolio and Ambit Capital's Emerging Giant which is a small-cap portfolio rose 19 percent each, data from PMSBazaar.com showed.

So where are the fund managers who manage the portfolios investing? We have taken a deeper look to understand the portfolio allocation of at least the top 5 funds.

There are as many as 25 stocks across five funds that were trusted the most amid the COVID-19 fall. The names include Sun Pharma, Dr Reddy’s, Polycab India, Garware Techfibers, Aarti Industries, Excel Industries, Hawkins Cooker, GMM Pfaudler and ICICI Bank, according to data compiled from PMSBazaar.com.

What are analysts suggesting?

Most experts are of the view that this is the best time to build or restructure your portfolio. Especially for the new investors, this could well turn out to be once in a decade kind of opportunity.

The market is a slave to earnings growth, and since it is difficult to ascertain earnings growth for the near future, other parameters such as Market Cap/GDP and Earnings Yield-Bond Yield (EY-BY) suggest that it is time to buy.

MCap/GDP is around 55 percent, which was last seen at the end FY09 (the aftermath of GFC), data showed. The current EY-BY level is close to 1, and from such levels historically, the median return from equities over the next 3 years has been ~20% CAGR.

“Whenever this ratio has been 60 percent or lower, there is a high probability of superior returns over the next 3 yrs – historically (as measured by Nifty) ranging from 20-30% CAGR,” Virendra Somwanshi, Managing Director & CEO at Motilal Oswal Private Wealth Management told Moneycontrol.

“Rather than waiting for the next bull market, it would be advisable to build equity portfolios for the long term as per your Risk Profile by staggering investments over the next 6-12 months,” he said.

Somwanshi further added that the underlying strategies should predominantly consist of companies that are leaders in their respective industries, which generate free cash flow and run by high-quality management.

Equity investors have to be always prepared for a volatile ride, given the nature of the investment vehicle they have chosen. The business environment is expected to witness a sea of change as economies exit from the lockdown and limp to normalcy, suggest experts.

The life post-COVID-19 would be different and the world would have to adjust to a new normal. If you have a time horizon of 5 years or so, investors could opt for an aggressive portfolio.

“A conservative portfolio should have a harmonious distribution of equities, debt, real estate and gold. An aggressive investor can afford to look at a slight skew towards equities in wake of the correction seen lately with an investment horizon not less than 5 years,” Pankaj Bobade, Head- Fundamental Research, Axis Securities Limited told Moneycontrol.

“Taking the same into consideration, an aggressive investor should add equities in a staggered manner over the period of next 6-12 months to construct an equity portfolio that would be able to give him the additional returns to take care of the associated risk,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!